MEDICARE SUPPLEMENT INSURANCE PLANS

MEDICARE WAS NEVER DESIGNED TO COVER ALL OF YOUR MEDICAL COSTS. A MEDICARE SUPPLEMENT INSURANCE PLAN PROTECTS YOU FROM UNCOVERED COSTS

GET A FREE QUOTE

Medicare Supplement INSURANCE plans, also called Medigap, help cover some of the medical expenses that ORIGINAL Medicare does not.

What ISN'T Covered By ORIGINAL Medicare?

Hospital Stay (2024)

$1,632 deductible for each benefit period.

- Days 1–60: $0 coinsurance for each benefit period.

- Days 61–90: $408 coinsurance per day of each benefit period.

- Days 91 and beyond: $816 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond lifetime reserve days: all costs.

Skilled Nursing Stays

After 20 days, you could pay up to $204 a day at a skilled nursing facility without Medigap coverage.

Medicare Part B

Medicare Part B has a $240 yearly deductible. And with many medical services you’ll have to pay 20% of the bill as coinsurance. A Medigap plan can help cover these costs.

What Do I Need to Get a Supplement Plan?

The More Coverage, The Better

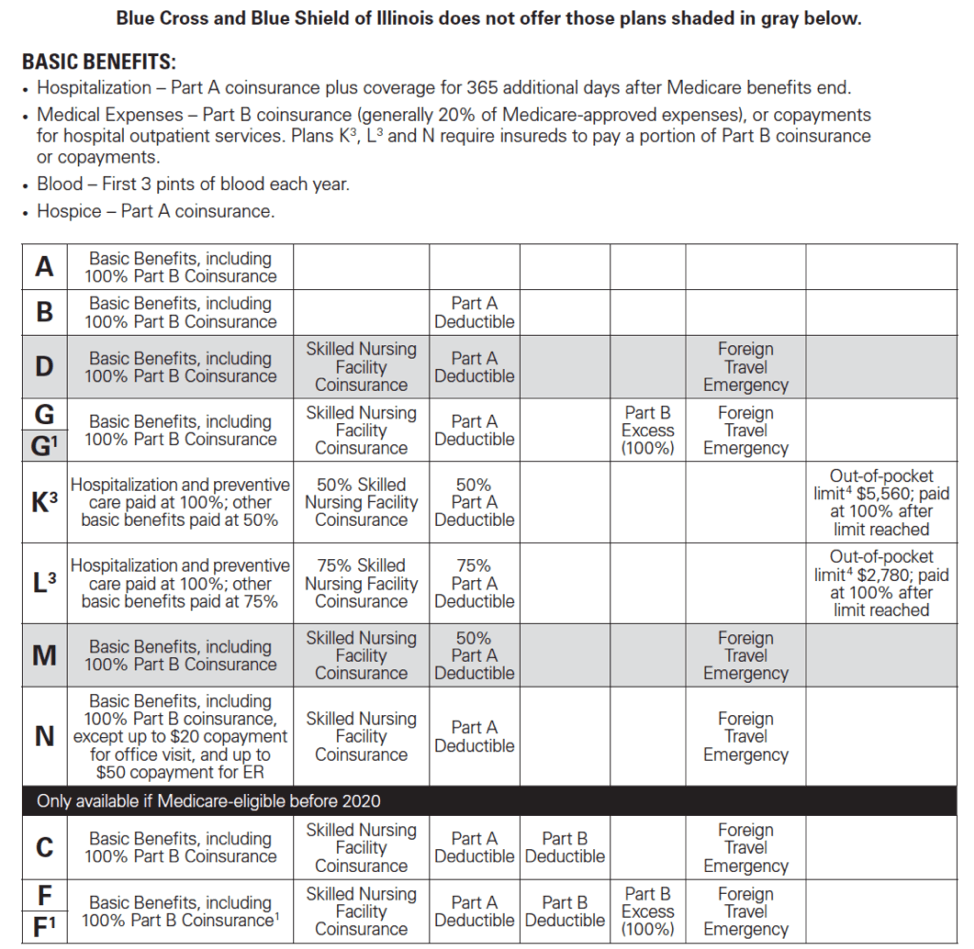

MEDICARE SUPPLEMENT INSURANCE CHART

- Coinsurance

- Copayments

- Deductibles

- Skilled nursing facility care coinsurance

- Foreign travel emergency care